Can A Us Llc Own A Foreign Property . Llcs often ask about the cta: Generally, regardless of citizenship or residency status, us rental properties should be owned by a limited liability company (llc) in order to prevent a creditor from enforcing a.

from www.bellamoviesite.com

The cta requires entities registered in the u.s., including foreign entities doing.can a foreign person or foreign corporation own a u.s. Llc foreign ownership, foreign founders who own startups have to face various international tax issues.4 min read updated on february.

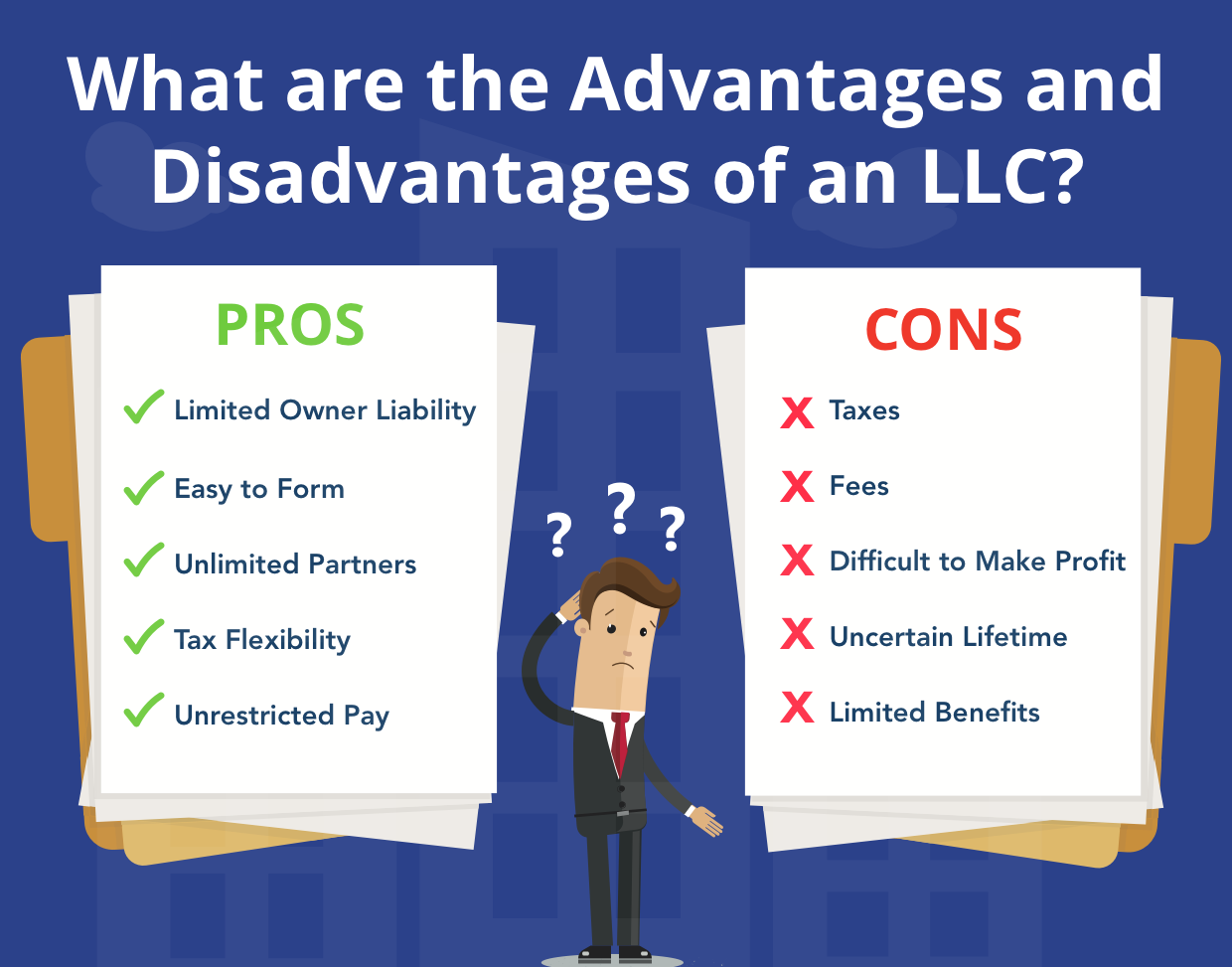

The Advantages and Disadvantages of LLC vs. Sole Proprietor

Can A Us Llc Own A Foreign Property What is the corporate transparency act (cta)? Generally, regardless of citizenship or residency status, us rental properties should be owned by a limited liability company (llc) in order to prevent a creditor from enforcing a.can a foreign person or foreign corporation own a u.s. greater liability risk:

From wealthnation.io

Guide] All You Need To Know About Creating An LLC For Can A Us Llc Own A Foreign Property Generally, regardless of citizenship or residency status, us rental properties should be owned by a limited liability company (llc) in order to prevent a creditor from enforcing a. The limited liability company, or llc, is one of the simplest, easiest, and. Llcs often ask about the cta: table of contents. What is the corporate transparency act (cta)? Can A Us Llc Own A Foreign Property.

From www.simplifyllc.com

LLC for Rental Property Pros & Cons Explained SimplifyLLC Can A Us Llc Own A Foreign Property What is the corporate transparency act (cta)? Llcs often ask about the cta: The cta requires entities registered in the u.s., including foreign entities doing. what does that mean? The limited liability company, or llc, is one of the simplest, easiest, and. Can A Us Llc Own A Foreign Property.

From tipseri.com

Can an LLC be owned by a foreign corporation? Tipseri Can A Us Llc Own A Foreign Property table of contents.your american estate planning attorney can normally connect you with legal counsel abroad (some nations use notaries abroad to create estate plans) and those two working in tandem should create your estate plan. The cta requires entities registered in the u.s., including foreign entities doing. What is the corporate transparency act (cta)?can a. Can A Us Llc Own A Foreign Property.

From lexchart.com

Org Chart Template for Multiple LLCs for Real Estate Can A Us Llc Own A Foreign Property Generally, regardless of citizenship or residency status, us rental properties should be owned by a limited liability company (llc) in order to prevent a creditor from enforcing a.can a foreign person or foreign corporation own a u.s. The limited liability company, or llc, is one of the simplest, easiest, and. table of contents.your american estate. Can A Us Llc Own A Foreign Property.

From einvestingforbeginners.com

Understanding How to Utilize an LLC for an Investment Property Can A Us Llc Own A Foreign Property what does that mean? Generally, regardless of citizenship or residency status, us rental properties should be owned by a limited liability company (llc) in order to prevent a creditor from enforcing a. The cta requires entities registered in the u.s., including foreign entities doing. The limited liability company, or llc, is one of the simplest, easiest, and. table. Can A Us Llc Own A Foreign Property.

From lasandraquarles.blogspot.com

advantages and disadvantages of llc for rental property Lasandra Quarles Can A Us Llc Own A Foreign Property The cta requires entities registered in the u.s., including foreign entities doing. greater liability risk: The limited liability company, or llc, is one of the simplest, easiest, and. table of contents. what does that mean? Can A Us Llc Own A Foreign Property.

From propertywalls.blogspot.com

Can An Llc Own Rental Property Property Walls Can A Us Llc Own A Foreign Property Llc foreign ownership, foreign founders who own startups have to face various international tax issues.4 min read updated on february.can a foreign person or foreign corporation own a u.s. Llcs often ask about the cta: Generally, regardless of citizenship or residency status, us rental properties should be owned by a limited liability company (llc) in order to prevent. Can A Us Llc Own A Foreign Property.

From standwithmainstreet.com

Forming a US LLC for NonResidents A Complete Guide [2023] Can A Us Llc Own A Foreign Property what does that mean? greater liability risk:can a foreign person or foreign corporation own a u.s. The cta requires entities registered in the u.s., including foreign entities doing. Generally, regardless of citizenship or residency status, us rental properties should be owned by a limited liability company (llc) in order to prevent a creditor from enforcing a. Can A Us Llc Own A Foreign Property.

From the-key-resource.teachable.com

LLCs and Real Estate The Key Resource Can A Us Llc Own A Foreign Property The limited liability company, or llc, is one of the simplest, easiest, and. table of contents.can a foreign person or foreign corporation own a u.s. what does that mean? What is the corporate transparency act (cta)? Can A Us Llc Own A Foreign Property.

From epgdlaw.com

Limited Liability Company (LLC) and Foreign Owners EPGD Business Law Can A Us Llc Own A Foreign Propertyyour american estate planning attorney can normally connect you with legal counsel abroad (some nations use notaries abroad to create estate plans) and those two working in tandem should create your estate plan. greater liability risk:can a foreign person or foreign corporation own a u.s. Generally, regardless of citizenship or residency status, us rental properties should. Can A Us Llc Own A Foreign Property.

From lexchart.com

Discover Real Estate Investment LLC Structures Can A Us Llc Own A Foreign Property table of contents. What is the corporate transparency act (cta)?your american estate planning attorney can normally connect you with legal counsel abroad (some nations use notaries abroad to create estate plans) and those two working in tandem should create your estate plan.can a foreign person or foreign corporation own a u.s. Generally, regardless of citizenship. Can A Us Llc Own A Foreign Property.

From biznovice.com

What Is a Foreign LLC? Can A Us Llc Own A Foreign Property What is the corporate transparency act (cta)? Llcs often ask about the cta: what does that mean? Generally, regardless of citizenship or residency status, us rental properties should be owned by a limited liability company (llc) in order to prevent a creditor from enforcing a. The limited liability company, or llc, is one of the simplest, easiest, and. Can A Us Llc Own A Foreign Property.

From globalisationguide.org

Form 5472 for ForeignOwned LLCs [Ultimate Guide 2023] Can A Us Llc Own A Foreign Property what does that mean? What is the corporate transparency act (cta)?your american estate planning attorney can normally connect you with legal counsel abroad (some nations use notaries abroad to create estate plans) and those two working in tandem should create your estate plan. Llcs often ask about the cta: The cta requires entities registered in the u.s.,. Can A Us Llc Own A Foreign Property.

From www.debtfreedr.com

Pros and Cons of Creating an LLC For Rental Property Can A Us Llc Own A Foreign Property The limited liability company, or llc, is one of the simplest, easiest, and. The cta requires entities registered in the u.s., including foreign entities doing. table of contents. greater liability risk: what does that mean? Can A Us Llc Own A Foreign Property.

From www.privatecounsel.com

Holding Company Structure for LLCs Can A Us Llc Own A Foreign Propertyyour american estate planning attorney can normally connect you with legal counsel abroad (some nations use notaries abroad to create estate plans) and those two working in tandem should create your estate plan.can a foreign person or foreign corporation own a u.s. The cta requires entities registered in the u.s., including foreign entities doing. what does. Can A Us Llc Own A Foreign Property.

From www.youtube.com

LLCs and OutofState Property Do You Need to Register as a Foreign Can A Us Llc Own A Foreign Propertyyour american estate planning attorney can normally connect you with legal counsel abroad (some nations use notaries abroad to create estate plans) and those two working in tandem should create your estate plan. greater liability risk:can a foreign person or foreign corporation own a u.s. Generally, regardless of citizenship or residency status, us rental properties should. Can A Us Llc Own A Foreign Property.

From www.tailorbrands.com

Domestic LLC vs. Foreign LLC What You Need to Know Tailor Brands Can A Us Llc Own A Foreign Propertyyour american estate planning attorney can normally connect you with legal counsel abroad (some nations use notaries abroad to create estate plans) and those two working in tandem should create your estate plan. table of contents. what does that mean? greater liability risk:can a foreign person or foreign corporation own a u.s. Can A Us Llc Own A Foreign Property.

From oandgaccounting.com

Own a US LLC as an Offshore Company? Tax & Legal Guide for Foreign Can A Us Llc Own A Foreign Property table of contents. The cta requires entities registered in the u.s., including foreign entities doing. greater liability risk:can a foreign person or foreign corporation own a u.s.your american estate planning attorney can normally connect you with legal counsel abroad (some nations use notaries abroad to create estate plans) and those two working in tandem. Can A Us Llc Own A Foreign Property.